Making Best Use Of Efficiency and Precision With Comprehensive Payroll Providers for Tiny Organizations

With the complexities of tax obligation laws, worker benefits, and pay-roll computations, the requirement for detailed payroll services ends up being significantly apparent. As small services aim to navigate the complex landscape of pay-roll management, a critical partnership with trustworthy payroll services can show to be the cornerstone in accomplishing functional quality and financial stability.

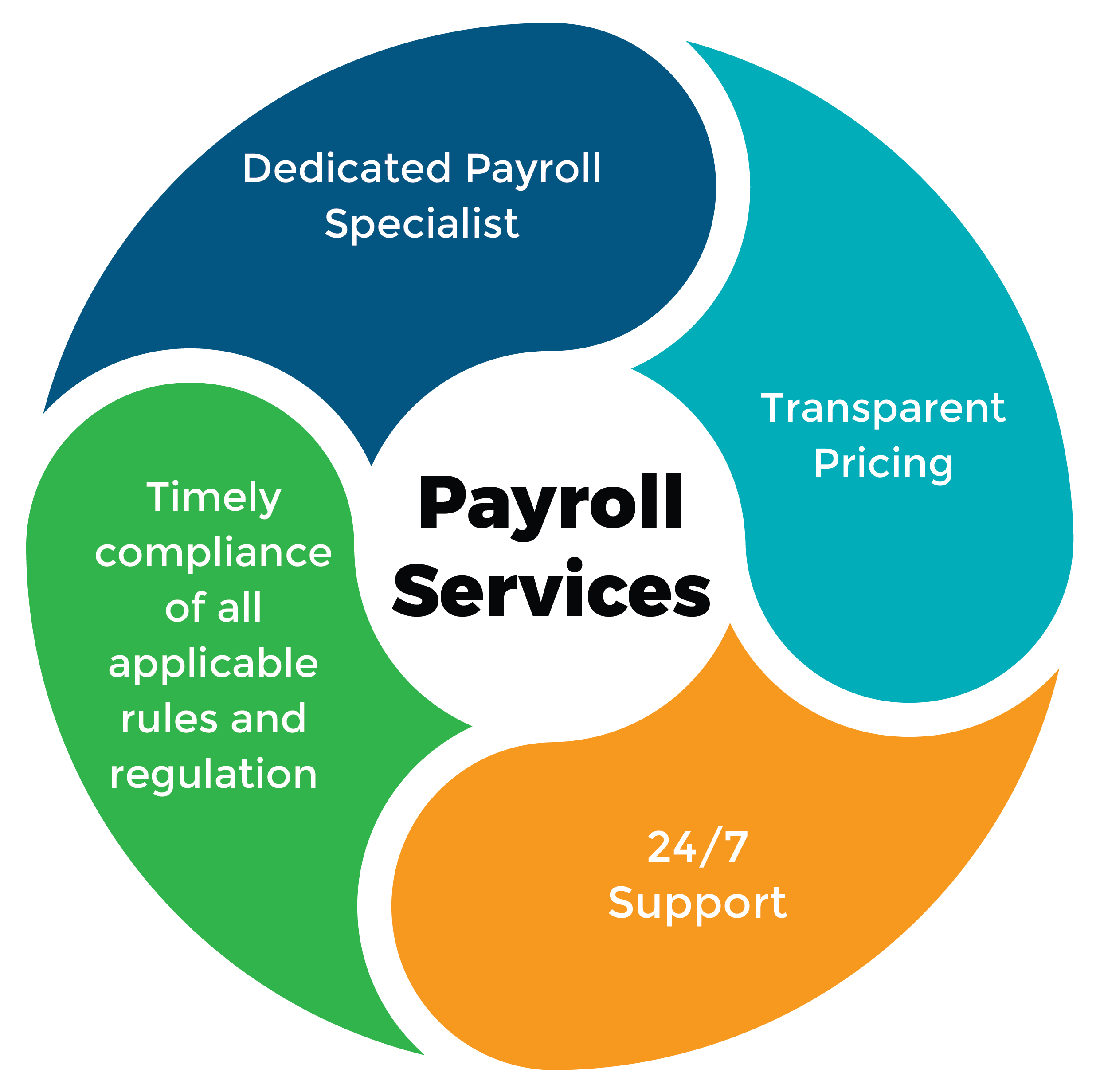

Significance of Comprehensive Pay-roll Provider

Making sure timely and precise payroll handling is important for the monetary stability and compliance of tiny organizations. Comprehensive pay-roll services play a crucial function in managing worker compensation, deductions, tax obligations, and advantages effectively. By contracting out payroll jobs to a customized provider, local business can simplify their procedures, reduce mistakes, and remain up-to-date with ever-changing tax guidelines.

One trick benefit of detailed pay-roll solutions is the removal of manual errors that can happen when refining pay-roll in-house. Pay-roll company make use of advanced software application to automate calculations and create accurate paychecks, lessening the danger of errors that can cause expensive charges or annoyed staff members. Furthermore, these solutions help little businesses stay certified with local, state, and federal tax obligation legislations by managing tax withholdings, filings, and reporting demands.

Simplifying Payroll Procedures

Additionally, establishing direct deposit choices for employees can further improve the payment process, eliminating the need for physical checks and reducing management expenses. Regularly reviewing and enhancing payroll process can help determine inadequacies or bottlenecks, allowing organizations to make needed adjustments for smoother procedures.

Moreover, contracting out pay-roll services to professional suppliers can use local business access to know-how and resources that can dramatically enhance pay-roll processes. These companies can deal with complex pay-roll tasks effectively, releasing up useful time for company owner to concentrate on core operations and growth approaches. Ultimately, streamlining pay-roll processes brings about boosted accuracy, conformity, and total efficiency within local business.

Making Certain Compliance and Accuracy

For local business, preserving compliance and precision in payroll procedures is extremely important for economic stability and lawful adherence. Guaranteeing that pay-roll procedures line up with current guidelines and regulations is critical to avoid fines and legal problems. Small organizations face challenges in staying on top of the ever-changing landscape of payroll tax, wage laws, and reporting requirements. By making use of hop over to these guys thorough pay-roll solutions customized to tiny businesses, proprietors can navigate these intricacies with confidence.

Expert payroll services supply local business with the know-how required to remain certified with federal, state, and regional guidelines. From calculating taxes and deductions to over here preparing accurate payroll records, these services provide a dependable solution to make sure accuracy in every action of the pay-roll process. Furthermore, remaining compliant with regulations such as the Fair Labor Standards Act (FLSA) and the Affordable Care Act (ACA) is crucial for preventing penalties and preserving a favorable track record.

Cost-Effective Pay-roll Solutions

To optimize financial performance, little companies can explore cost-effective pay-roll options that enhance processes and minimize expenditures. By outsourcing payroll, tiny companies can benefit from the experience of specialists who can ensure conformity with tax obligation policies and handle all payroll-related jobs efficiently. Inevitably, by carrying out these affordable pay-roll options, small organizations can designate their resources a lot more efficiently, focus on core service activities, and attain greater economic stability.

Leveraging Modern Technology for Effectiveness

Utilizing sophisticated technological devices can substantially improve operational effectiveness in managing pay-roll processes for small companies. Automation plays an essential function in enhancing different payroll jobs, such as calculating staff member wages, reductions, and taxes. Payroll software application can automate time monitoring, generate digital pay stubs, and assist in straight down payments, decreasing hands-on mistakes and conserving time. Furthermore, cloud-based pay-roll from this source systems offer local business the adaptability to accessibility pay-roll information anytime, anywhere, and ensure data safety and security with security and safe and secure web servers.

Moreover, incorporating pay-roll software program with other HR and accounting systems can create a smooth circulation of info, getting rid of the need for hand-operated data entrance and minimizing the danger of inconsistencies. Advanced functions like automatic tax computations, conformity updates, and record generation additional streamline pay-roll management for small companies. Accepting mobile applications enables staff members to access their pay-roll details easily, enhancing openness and interaction within the organization. By leveraging modern technology effectively, little organizations can maximize their payroll procedures, reduce prices, and enhance total efficiency.

Final Thought

Finally, detailed pay-roll services play a crucial function in taking full advantage of efficiency and precision for small companies (Contact CFO Account & Services for payroll services). By simplifying processes, making certain conformity, and leveraging technology, services can save time and sources while minimizing errors. Cost-efficient solutions even more boost the advantages of outsourcing pay-roll solutions. Generally, the significance of extensive pay-roll solutions can not be overemphasized in aiding tiny businesses operate smoothly and successfully.

As tiny organizations make every effort to browse the detailed landscape of pay-roll administration, a critical collaboration with reliable pay-roll solutions can show to be the cornerstone in attaining functional excellence and financial stability.

Comments on “Dependable Payroll Management Solutions-- Contact CFO Account & Services for Payroll Services”